Anne Borre Events & Insights

Exploring the latest trends and stories from Anne Borre.

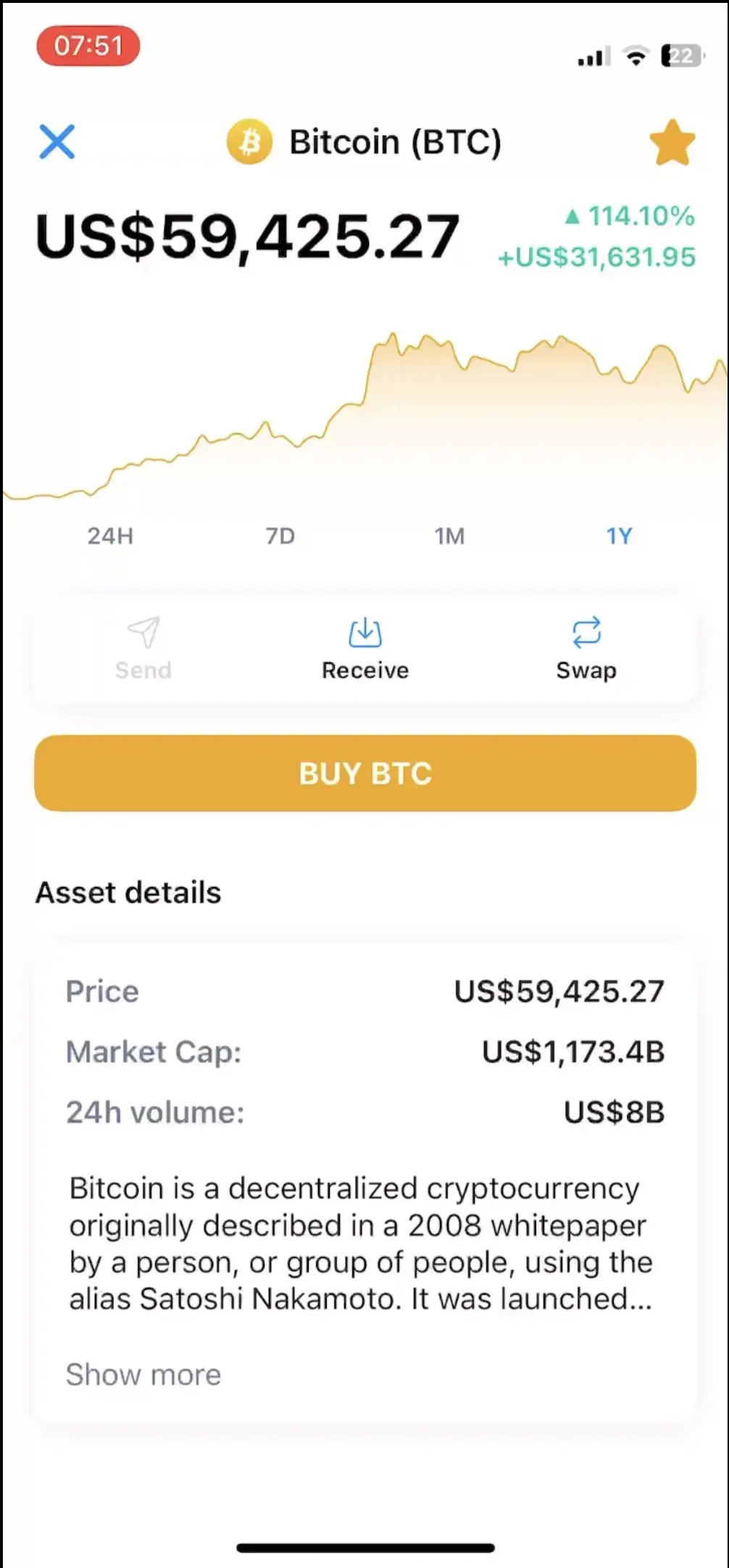

Bitcoin: The New Digital Gold Rush

Discover how Bitcoin is revolutionizing wealth in the digital age—join the gold rush and unlock your financial future today!

What You Need to Know Before Investing in Bitcoin

Investing in Bitcoin can be both exciting and overwhelming for new investors. Before diving in, it’s crucial to understand the volatility associated with this cryptocurrency. Unlike traditional investments, the price of Bitcoin can fluctuate dramatically in short periods. According to a Investopedia article, this volatility can be influenced by market sentiment, regulatory news, and technological advancements. Thus, educating yourself about these factors can help you make informed decisions.

Another important aspect to consider is the security of your Bitcoin investment. It’s essential to use a reputable wallet to store your digital assets. There are several types of wallets, including hardware wallets, software wallets, and paper wallets. Each comes with its own risks and benefits. A comprehensive guide to these options can be found in this CoinDesk article. Additionally, always be aware of phishing scams and enable two-factor authentication for added security.

How Bitcoin is Reshaping the Financial Landscape

Bitcoin, the pioneering cryptocurrency, is profoundly reshaping the financial landscape by introducing a decentralized system that challenges traditional banking models. With its underlying blockchain technology, Bitcoin enables peer-to-peer transactions that eliminate the need for intermediaries, resulting in reduced transaction costs and faster processing times. As global adoption grows, institutions and individuals alike are beginning to recognize the benefits of using Bitcoin, including inflation resistance and increased accessibility. According to a Coindesk article, over 100 million wallets for holding Bitcoin have been established, showcasing its rising popularity.

Moreover, Bitcoin's impact extends beyond mere transactions; it is driving innovation in various sectors. Financial instruments such as blockchain-based smart contracts and decentralized finance (DeFi) are becoming prominent, offering new opportunities for investment and economic modeling. Companies are increasingly investing in Bitcoin as a legitimate asset class, contributing to its volatility and potential for high returns. A recent Forbes article highlights how major corporations are adding Bitcoin to their balance sheets, thereby legitimatizing its status in the global financial system.

Is Bitcoin the Future of Money or Just a Fad?

The question of whether Bitcoin is the future of money or just a passing fad has sparked debate among economists, investors, and tech enthusiasts alike. Proponents argue that Bitcoin, as the first decentralized cryptocurrency, introduces a revolutionary way of conducting transactions without the need for traditional banking systems. Its underlying blockchain technology offers transparency and security, making it an appealing alternative to fiat currencies. You can explore more about this technology in articles from Investopedia and Forbes. However, skeptics point to its volatility and regulatory challenges, questioning the sustainability of its value over time.

Despite its ups and downs in the market, Bitcoin's growing acceptance among businesses and financial institutions may indicate a shift toward a more digitized economy. Notably, companies like Shopify and PayPal have started to incorporate Bitcoin into their payment systems, suggesting that the cryptocurrency could play a significant role in the future of commerce. Ultimately, whether Bitcoin becomes the standard for future transactions or merely remains a trend will depend on its ability to address its current limitations and expand its use cases in everyday life.