Anne Borre Events & Insights

Exploring the latest trends and stories from Anne Borre.

Term Life Insurance: A Safety Net You Didn't Know You Needed

Discover how term life insurance can provide unexpected security for your loved ones—don’t miss this essential safety net!

Understanding the Benefits of Term Life Insurance: Is It Right for You?

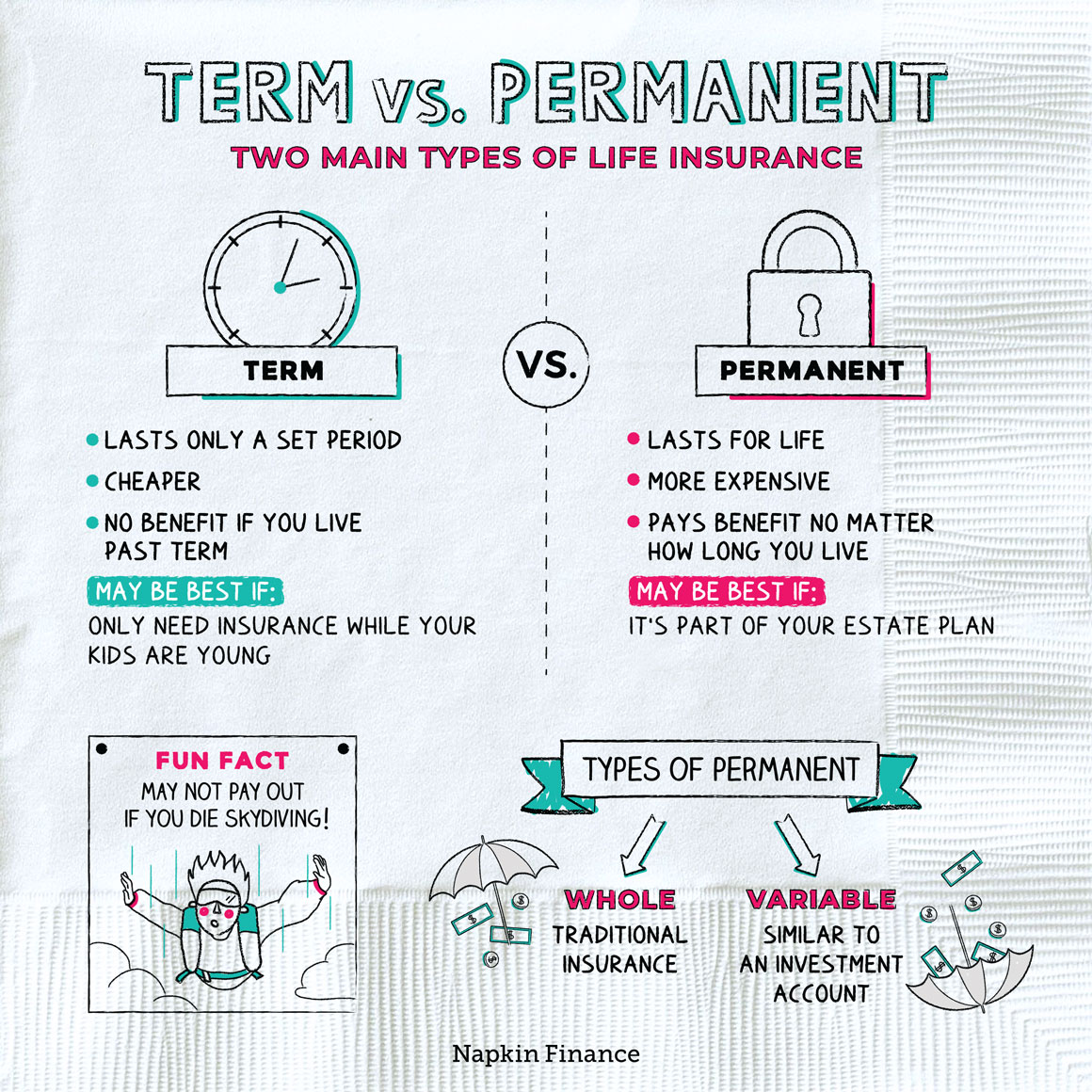

Term life insurance is a straightforward and cost-effective solution for individuals seeking financial protection for their loved ones. Unlike whole life insurance, which accumulates cash value over time, term life provides coverage for a specific period—typically ranging from 10 to 30 years. This type of policy is particularly beneficial for those who want to ensure their family can maintain their lifestyle in the event of an unexpected death during critical financial years, such as raising children or paying off a mortgage.

One of the primary advantages of term life insurance is its affordability. Premiums for term policies tend to be significantly lower than those for permanent life insurance options. This makes it an attractive choice for young families or individuals on a budget who still wish to secure coverage. Additionally, as your life circumstances change, such as achieving financial stability, it's easy to reassess your insurance needs—whether that means converting to a permanent policy or simply allowing the term to lapse when it is no longer necessary.

How Term Life Insurance Provides Financial Security for Your Loved Ones

Term life insurance is a crucial financial tool that offers peace of mind by ensuring your loved ones are protected in the event of an unexpected tragedy. By purchasing a policy, you can specify a coverage amount that would be paid out to your beneficiaries upon your passing, providing them with vital financial support during a challenging time. This payout can help cover essential expenses such as mortgage payments, educational costs, and daily living expenses, allowing your family to maintain their standard of living without the burden of financial distress.

Moreover, one of the greatest advantages of term life insurance is its affordability compared to whole life insurance policies. This makes it accessible for many families seeking financial security without straining their budgets. With various term lengths available, you can select a policy that aligns with your family's financial needs, whether it's for a specific number of years or until key financial obligations are met. In essence, investing in term life insurance is a proactive approach to ensuring your loved ones' future is safeguarded, providing them with the support they need when they need it most.

Top 5 Myths About Term Life Insurance Debunked

When it comes to understanding term life insurance, many misconceptions abound. One common myth is that term life insurance is only beneficial for young individuals or families with children. In reality, term life insurance can be a smart choice for anyone needing temporary financial protection, whether you're starting a career, planning for retirement, or even paying off debts. Another prevalent idea is that once you outlive your policy, you've wasted your money. However, the primary purpose of term life insurance is to provide peace of mind and financial security to your loved ones in case of unforeseen events.

Another myth is that term life insurance is too expensive. In fact, many find that it offers affordable coverage options tailored to fit various budgets. Unlike permanent life insurance, term policies generally have lower premiums, making them an accessible option for a wider audience. Furthermore, some believe that term life insurance lacks flexibility. On the contrary, many policies allow you to convert to permanent coverage later on, providing a valuable safety net as your life circumstances change.