Anne Borre Events & Insights

Exploring the latest trends and stories from Anne Borre.

Term Life Insurance: Your Safety Net in Disguise

Unlock peace of mind with term life insurance—your hidden safety net! Discover how it can protect your loved ones today!

Understanding Term Life Insurance: Key Benefits for Your Financial Future

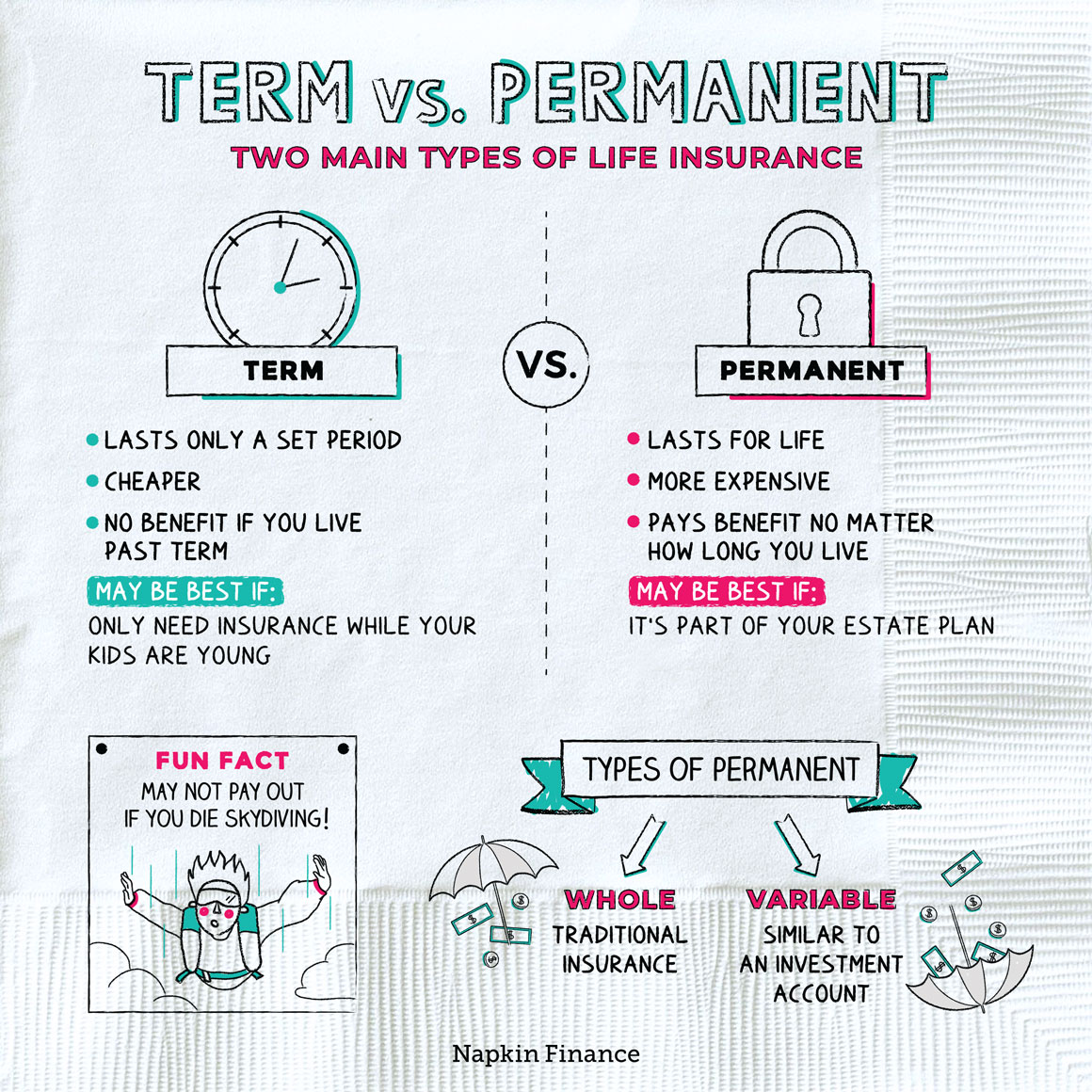

Term life insurance is a straightforward and affordable way to provide financial security for your loved ones in the event of your untimely passing. Unlike whole life insurance, which accumulates a cash value, term life is designed to offer pure protection for a specified period, typically ranging from 10 to 30 years. This means that if you pass away within the term of the policy, your beneficiaries will receive the death benefit, which can help cover essential expenses such as mortgages, college tuition, and day-to-day living costs. Understanding the key benefits of term life insurance is crucial to ensuring your family is safeguarded financially in the future.

One of the greatest advantages of term life insurance is its affordability. Premiums for term life policies are generally lower compared to whole life policies, making it an attractive option for families on a budget. This affordability allows policyholders to secure substantial coverage that can provide peace of mind without breaking the bank. Additionally, many term life policies offer the option to convert into a permanent policy later on, allowing for flexibility as your financial situation evolves. By investing in term life insurance, you are taking an important step toward protecting your family's financial future.

Is Term Life Insurance Right for You? 5 Questions to Consider

When evaluating whether term life insurance is right for you, it's essential to start by asking yourself a few fundamental questions. First, consider your current financial situation: Do you have dependents who rely on your income? If so, term life insurance can provide a safety net for your loved ones, ensuring that they remain financially secure in the event of your untimely passing. Additionally, think about your debts and other financial obligations. Would your family be able to manage these responsibilities without your income? If the answer is no, it’s worth exploring term life insurance as a viable option.

Next, evaluate your long-term financial goals and needs. Ask yourself: how long do you need coverage? Since term life insurance is designed to only last for a specific period—typically ranging from 10 to 30 years—it's crucial to align the duration of the policy with your life stages and financial commitments. Moreover, consider the affordability of premiums; term life insurance is often more budget-friendly compared to whole life policies. By weighing these factors, you can better determine if term life insurance will fit into your overall financial plan and offer the protection you need.

The Hidden Advantages of Term Life Insurance: Beyond Basic Coverage

Term life insurance is often perceived merely as a safety net that provides death benefits to beneficiaries, yet its advantages extend far beyond this basic coverage. One hidden benefit is its affordability, particularly when compared to whole life insurance. This lower premium allows families to allocate more resources towards other critical areas, such as saving for education or investing in retirement funds. Additionally, many policies offer options to convert to permanent insurance without the need for additional medical underwriting, facilitating a smoother transition as life circumstances change.

Moreover, term life insurance comes with flexible coverage options that can be tailored to fit various life stages. For instance, young families may choose a longer term to ensure their children are financially secure until adulthood, while older individuals might select shorter terms that coincide with specific financial obligations like mortgage repayments. Furthermore, some policies include riders that enhance the overall value, such as accelerated death benefits, which allow policyholders to access a portion of their death benefit in the event of a terminal illness. Such features exemplify how term life insurance can be a strategic component of a comprehensive financial plan, offering peace of mind and financial security.