Anne Borre Events & Insights

Exploring the latest trends and stories from Anne Borre.

Regulating the Unruly: What You Need to Know About Crypto Rules

Discover the essential crypto rules you need to navigate the chaotic world of digital currency and stay ahead of the game!

Understanding Cryptocurrency Regulations: A Comprehensive Guide

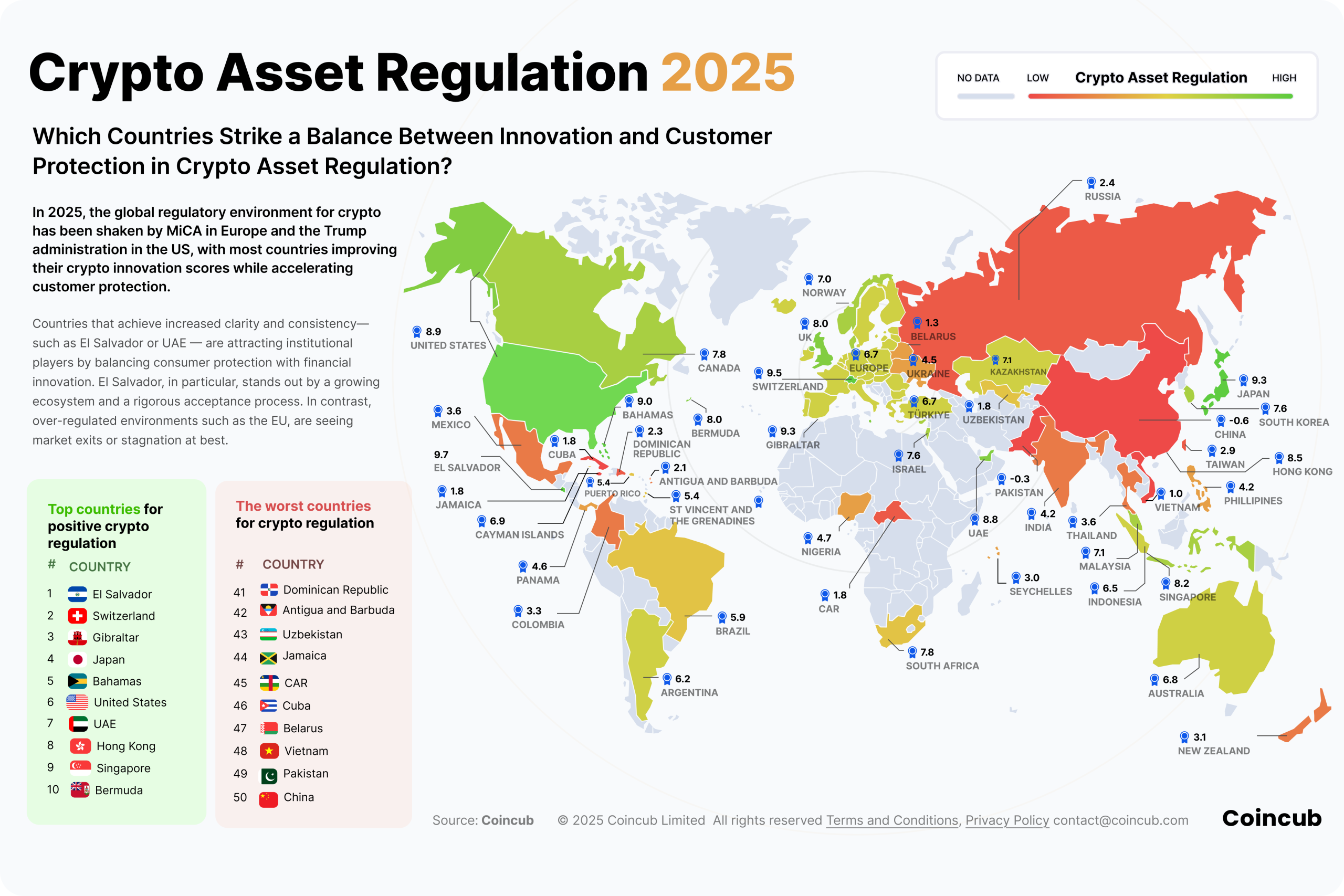

In recent years, the rise of cryptocurrencies has transformed the financial landscape, prompting governments worldwide to rethink regulatory frameworks. Understanding cryptocurrency regulations is crucial for anyone involved in this space, whether investors, developers, or traders. Each country approaches regulation differently, leading to a patchwork of laws regarding cryptocurrency transactions, taxation, and consumer protection. It's essential to stay informed about these regulations to ensure compliance and to navigate the complexities of the crypto market effectively.

Furthermore, the regulatory environment surrounding cryptocurrencies can significantly impact their value and adoption. As governments look to impose stricter measures on cryptocurrency exchanges and Initial Coin Offerings (ICOs), stakeholders need to keep an eye on potential changes. To help you navigate this complex field, we've compiled a list of key topics to consider:

- Jurisdictional Variations

- Tax Implications

- Securities Regulations

- AML and KYC Requirements

- Future Trends in Regulation

By understanding these factors, you can better anticipate how regulatory changes may influence your cryptocurrency investments and strategies.

Counter-Strike is a popular first-person shooter game that has been captivating gamers since its release. Players can engage in intense multiplayer matches and hone their skills in strategy and teamwork. To enhance your gaming experience, consider checking out the betpanda promo code for some exciting offers.

Top 5 Questions About Crypto Regulation Answered

As cryptocurrency continues to gain traction globally, many investors and enthusiasts are left wondering about the implications of crypto regulation. One of the most frequently asked questions is: What is the current state of crypto regulation worldwide? The regulatory landscape varies significantly from one country to another. While nations like the United States and the European Union are actively developing frameworks to govern cryptocurrency activities, others maintain a more hands-off approach. This inconsistency creates a complex environment for users looking to navigate the crypto space responsibly.

Another common inquiry is: How do regulations affect cryptocurrency prices? Generally, clarity in regulation often leads to increased market confidence, which can positively impact prices. For instance, when a country announces favorable policies, it might encourage investments and drive prices up. Conversely, restrictive measures can create uncertainty, leading to volatility and price dips. Understanding these dynamics is crucial for anyone looking to invest in digital currencies or engage in the broader crypto ecosystem.

How Global Policies are Shaping the Future of Cryptocurrency

As the global landscape continues to evolve, global policies surrounding cryptocurrency are becoming increasingly significant. Governments worldwide are starting to recognize the potential of digital currencies, which has led to varying degrees of regulation. For instance, countries like China have implemented strict regulations to curb cryptocurrency trading, while others, such as El Salvador, have embraced Bitcoin as legal tender. These divergent approaches highlight the need for a cohesive international framework that can promote innovation while ensuring financial stability, impacting how cryptocurrencies are adopted and utilized across the globe.

The influence of global policies extends beyond mere regulations; they also affect market perception and technological advancements in the crypto space. Policies that encourage transparency and protect consumers can foster a more robust environment for blockchain technologies and decentralized finance (DeFi). Furthermore, with institutions like the International Monetary Fund (IMF) and the Financial Stability Board (FSB) weighing in on digital currencies, it’s clear that coordinated efforts are underway. As these international policies take shape, they will undoubtedly play a crucial role in defining the trajectory of the cryptocurrency market for years to come.