Anne Borre Events & Insights

Exploring the latest trends and stories from Anne Borre.

Valuations on Sale: Snagging Deals After the Market Dip

Discover hidden gems in the market dip! Uncover unbeatable deals and learn savvy strategies to snag prime valuations before they're gone.

5 Key Strategies for Identifying Value Stocks After a Market Dip

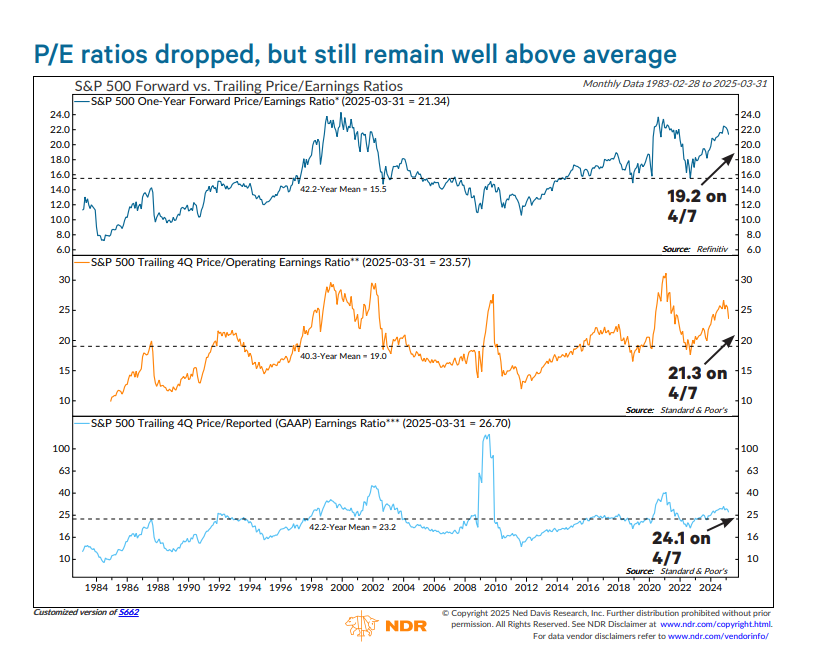

Identifying value stocks after a market dip can be a rewarding strategy for investors looking to capitalize on temporary price declines. One key strategy is to conduct thorough fundamental analysis. Start by evaluating crucial metrics such as the company's price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield. Stocks trading at a lower P/E compared to their historical averages or industry peers may indicate an undervalued asset. Additionally, consider assessing the company's debt levels and cash flow to ensure it can weather economic downturns.

Another effective approach is to analyze market sentiment and news surrounding the stock. Often, panic selling can drive prices down regardless of a company’s long-term potential, presenting opportunities for savvy investors. Thirdly, diversification is vital; consider allocating funds across various sectors to mitigate risk. Finally, employing tools such as stock screeners can further refine your search for value stocks, allowing you to filter based on preferred metrics. By applying these strategies, you can uncover promising investments that have the potential for significant returns as the market recovers.

Counter-Strike is a popular first-person shooter franchise that has captivated gamers for decades. Known for its team-based gameplay, it emphasizes strategy and skill. Recently, discussions have emerged around the skin market recovery as players anticipate changes in the game's economy.

Are You Missing Out? Top Tips for Snagging Deals in a Volatile Market

In today's volatile market, identifying and seizing the right opportunities can make a significant difference in your financial strategy. It’s crucial to stay informed about market trends and consumer behavior to avoid missing out on deals that could enhance your portfolio. Start by subscribing to financial news outlets and utilizing market analysis tools. Developing a keen eye for fluctuations will enable you to spot undervalued assets and take action before the competition does.

Another effective strategy for snagging deals is to network within your industry. Engage with other investors, attend webinars, and participate in community forums to share insights and tips. You can also leverage social media platforms where industry leaders share their opinions and emerging trends. To make the most of your connections, consider these steps:

- Join relevant groups and forums.

- Attend live events and webinars.

- Follow influencers and experts on social media.

Don’t let the unpredictability of the market deter you—stay proactive and vigilant, and you might just discover lucrative opportunities before they disappear.

What to Look for When Seeking Value After a Market Correction

Market corrections often present unique opportunities for savvy investors looking to identify undervalued assets. When seeking value after a market correction, the first step is to conduct thorough research on companies that have demonstrated strong fundamentals, such as consistent earnings growth, robust balance sheets, and a competitive advantage within their industry. Look for stocks that have fallen significantly in price but still possess solid underlying business models. Valuation metrics like Price-to-Earnings (P/E) ratios and Price-to-Book (P/B) ratios can help highlight underrated stocks worth considering.

Another key factor to consider is the overall market sentiment and economic environment post-correction. While bargains may be plentiful, it's essential to evaluate whether a company's issues are temporary or symptomatic of deeper problems. Investors should keep an eye on the market trends and consider sectors that typically rebound after downturns. Additionally, utilizing tools such as technical analysis can provide insights on potential entry points, allowing investors to make informed decisions that maximize their returns on these value investments.